Insights

Shaping the Future of Branded Living

Maison 71 Insights curates perspectives, analysis, and trend reports at the forefront of the global real estate market.

Featured Articles:

UAE Real Estate Surges in 2025 hitting record Sales in Dubai and Abu Dhabi

The Rise of Automotive-Branded Living

Why Branded Residences Outperform in Uncertain Times

UAE real estate surges in 2025

Dubai hits record sales, while Abu Dhabi rents climb fast and the Northern Emirates gain fresh investor interest.

Dubai

Market performance

Around 91,800 transactions in H1 2025 with a value of about AED 262.1 billion.

Total sales already passed AED 525.87 billion before year end which is higher than the full year total for 2024.

Price per square foot reached about AED 1,640 which represents about 13 percent annual growth.

Rental environment

Rents increased around 8.5 percent year on year.

Apartment yields average around 6.78 percent which is still attractive compared with other global hubs.

Supply and pipeline

Around 61,800 units are under construction for delivery during the remainder of 2025.

One bedroom apartments dominate both off plan and ready transactions which shows strong demand at entry points.

Luxury segment

About 1,400 luxury transactions in H1 2025 with growth of around 62 percent compared with the previous period.

Branded residences and waterfront districts remain the main beneficiaries.

Abu Dhabi

Market performance

Market value around AED 94 billion driven by strong demand in Saadiyat, Yas, Raha and emerging investment zones.

Abu Dhabi is seeing faster rental growth than Dubai which indicates tightening supply in key districts.

Rental environment

Residential rents increased around 27.3 percent year on year.

Apartment yields average around 6.97 percent which is slightly higher than Dubai.

Drivers

Large scale masterplans, government backed cultural investments and high net worth population growth are driving premium demand.

Yas Island, Saadiyat Island, Jubail and Raha Beach continue to show solid absorption.

Outlook

Pricing in some locations may rise further through 2026 while others may stabilise depending on new stock releases.

Strong infrastructure and lifestyle developments continue to attract end users who prefer Abu Dhabi for quality of living.

Northern Emirates (Sharjah, Ras Al Khaimah, Ajman, Fujairah)

Sharjah

Continued demand for more affordable family communities.

Supply additions are moderating which may put gentle upward pressure on rents in 2026.

Popular with commuters who want more value compared with Dubai.

Ras Al Khaimah

Tourism led projects continue to attract resort investors.

New hospitality and branded residential schemes near Al Marjan Island are boosting interest from international buyers.

Prices remain lower than Dubai which creates opportunity for long term capital appreciation.

Ajman and Fujairah

Stable rental yields for mid market units.

Strong appeal to first time buyers who want lower entry pricing.

Infrastructure upgrades, ports and logistics growth support real estate demand.

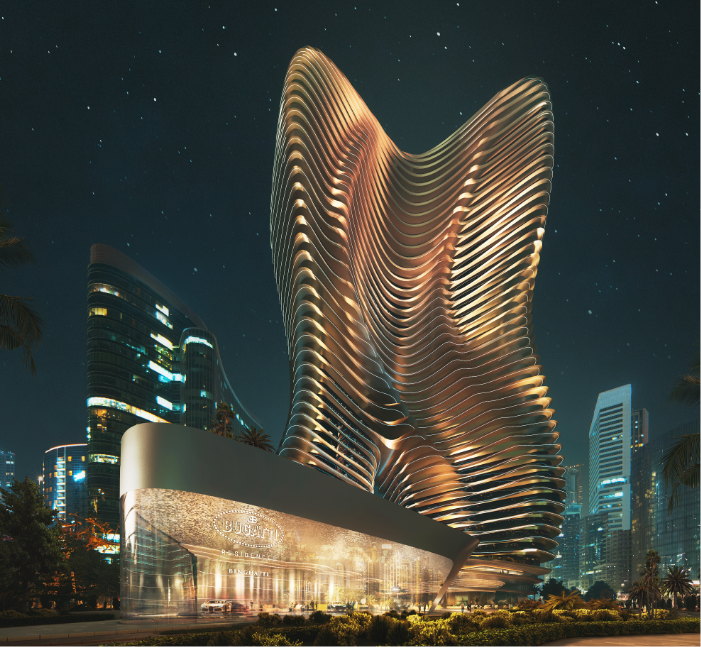

The Rise of Automotive-Branded Living

In the world of luxury real estate, one of the most intriguing trends of recent years is the emergence of automotive-branded residences, private homes developed in association with luxury car manufacturers that extend their brand DNA into architecture, interior design, services and lifestyle. Once the domain of hospitality brands, the “branded residence” concept is now being reinvented by car makers seeking to bring their craftsmanship, performance and exclusivity into the home.

What are automotive-branded residences?

Branded residences in general are residential properties developed in collaboration between a property developer and a globally recognised brand, often in hospitality, fashion or luxury lifestyle. According to recent industry research, the branded-residence market has grown from 159 projects in 2011 to over 611 by 2023, and continues to expand.

Automotive-branded residences are a subset of that trend where the brand partner is a luxury car manufacturer. For example:

Families can live in a tower carrying the name of Bugatti, Porsche, Aston Martin or Mercedes‑Benz.

The design, materials, and amenities in such residences draw on the automotive brand’s aesthetics, technology, and lifestyle ethos.

The value proposition includes exclusivity, prestige, association with a dream brand, and often unique features .

In short, these are homes that ask: what if driving your luxury car and living your luxury home were parts of the same curated brand experience?

Why the growth now?

Several factors converge to drive the rise of automotive-branded living:

Brand extension and lifestyle credibility

Luxury car manufacturers are increasingly thinking beyond the road. By entering real estate they can extend their brand into the asset that affluent clients live in, rather than just drive. It becomes about owning the lifestyle experience from home.

Growing appetite for branded residences

Data show that high-net-worth individuals are increasingly seeking residences that carry a luxury brand name. For example, in the UAE 69 % of HNWIs expressed interest in owning a branded property, up from 59 % the prior year.

Saturation of hotel-brand model and search for differentiation

While hotel-branded residences remain dominant, developers and brands are looking for new vectors of distinction. Automotive branding offers a fresh angle compared with more common hospitality or fashion-brand collaborations.

Design and technology synergies

Automotive design emphasises precision, materials, innovation, and high performance. These themes translate to architecture and interior design in ways that appeal to luxury buyers. As noted in one design-analysis: automotive and architectural design converge in the residential setting.

Increasing global wealth and investment appetite

Ultra-high net worth individuals are seeking destinations that offer exclusivity, status and investment upside. Branded residences answer that mix, they offer both a lifestyle and a portfolio asset.

Key features that define the category

Automotive-branded residences aren’t merely homes with a car logo plastered on. The best projects integrate several signature features:

Design DNA: Use of materials typically found in high-end automobiles – carbon fibre, premium leather, aluminium accents, bespoke finishes – applied in interiors and facade treatments.

Automotive-centric amenities: For example car elevators or direct car-to-residence garages, concierge services for vehicles, showroom spaces or drive-in experiences.

Lifestyle-driven services: Services beyond the typical residential offering — valet, detailing, car collection services, access to motorsport or brand-club events.

Location and visibility: Often in landmark towers or resort settings where the brand presence is visible and status-driven.

Investment appeal: Premium pricing relative to comparable non-branded luxury residences, and a scarcity factor tied to exclusivity. For example, branded residences in some markets command up to 69 % higher price.

Regional focus: Middle East and UAE

The UAE, and Dubai in particular, has become a hotspot for branded residences thanks to high demand for luxury living and a strong global investor base. For example “branded residences are emerging as the next big thing in Dubai real estate”.

Developer Binghatti Properties has announced multiple automotive-branded projects: the Bugatti Residences and Mercedes-Benz Places being two standout examples.

According to design business reports, automotive-branded developments in the Middle East are growing at an annual rate of 25-30 %.

Future outlook

The momentum behind automotive-branded living shows little sign of slowing. As one report notes: by 2030 non-hotel brands (including automotive) are projected to comprise 20% of all branded-residence developments.

For the next wave, expect:

Even more fusion between mobility and home: Think of residences designed for e-vehicles, automated garage logic, shared vehicle fleets, brand club experiences.

Greater global dispersion beyond traditional luxury hubs: While Miami, Dubai and Abu Dhabi lead today, secondary markets may emerge.

Expanded service-ecosystems: The branded home may tie into the broader brand experience—access to brand events, vehicle launches, curated travel offers, etc.

Increased focus on sustainability and tech: Automotive brands that already lead EV innovation will likely emphasise smart-home, low-carbon living and integrated mobility services in their residences.

More hybrid models combining hotels, residences and mobility hubs: This offers flexibility to owners (second-home, lock-up-and-leave) and rental income potential.

Why Branded Residences Outperform in Uncertain Times

When markets wobble, investors and buyers instinctively look for safe havens. Gold, bonds, and prime real estate usually make the list. Increasingly, however, branded residences are proving to be one of the most resilient asset classes in uncertain times.

These projects, anchored by hospitality giants like Four Seasons and Ritz-Carlton or lifestyle names like Armani and Porsche, combine luxury real estate with the credibility of global brands. The result is a product that consistently outperforms, even when traditional markets slow down.

In volatile environments, trust in the brand becomes a currency. Buyers know exactly what to expect: quality design, consistent service, and the assurance that the property will be maintained to world-class standards. That’s why branded residences command an average 30% price premium over non-branded peers, according to the Branded Residences Monitor (June 2025). In ultra-prime markets like Dubai and Miami, premiums can exceed 40%, and crucially, these premiums hold during downturns.

Uncertainty also makes buyers rethink priorities. Branded residences aren’t just homes; they’re turn-key lifestyle packages with concierge services, wellness programs, private clubs, and built-in communities. It’s no surprise that the Monitor shows wellness-led projects now make up more than 20% of the development pipeline, reflecting demand for health, longevity, and peace of mind.

Unlike conventional real estate, branded residences draw buyers from across the globe. The Monitor highlights that 45% of new investors in 2024–25 were non-residents, underscoring the cross-border appeal of these assets. When one local market slows, international demand steps in, insulating branded projects from domestic volatility.

For investors, performance is equally compelling. The Monitor notes that branded residences achieve yields up to 50% higher than non-branded luxury stock in markets like Bangkok, Dubai, and Miami. Over the long term, resale values outperform by around 25% over a decade.

“Branded residences deliver up to 50% stronger yields than non-branded luxury stock.”

In a world shaped by shocks, from pandemics to inflationary cycles, branded residences are emerging as the new safe haven of luxury real estate. They combine the reassurance of brand equity with the lifestyle aspirations of today’s high-net-worth buyers.

For developers, they remain a high-performing model. For investors, they offer stability and returns. And for buyers, they are more than just homes, they are havens of trust, wellness, and long-term value.

Branded Residences: Where Luxury Living Meets Lifestyle

It all begins with an idea.

Over the past two decades, branded residences have emerged as one of the most dynamic and resilient segments of global real estate. Blending the prestige of world-renowned brands with the comfort of home ownership, they have transformed how high-net-worth individuals (HNWIs) invest, live, and experience luxury.

What Are Branded Residences?

At their core, branded residences are private homes associated with an established brand, most often a luxury hospitality company, but increasingly also fashion houses, automotive icons, and lifestyle brands. Buyers purchase apartments, villas, or houses that come with the design, service, and operational standards of the brand.

The result? Owners enjoy not just a home but a lifestyle package that includes curated services, exclusive access, and the reassurance of globally recognized quality.

Why the Model Works

Trust in the Brand

Buyers know what to expect. Whether it’s a Four Seasons residence in Los Cabos or an Armani-designed tower in Dubai, the association with a respected brand reduces perceived risk.Premium Experience

Services often mirror those of five-star hotels with concierge, housekeeping, spa access, fine dining, and 24/7 security, making ownership as effortless as it is indulgent.Investment Appeal

Branded residences typically command a price premium (20–35% above non-branded equivalents). They also tend to outperform in resale value and rental yield, particularly in prime locations.Lifestyle & Community

Owners buy into more than real estate; they join a like-minded global community of affluent individuals who share tastes, values, and networks.

Global Growth

According to industry reports, the number of branded residence schemes worldwide has more than doubled in the past decade. Once concentrated in North America, the sector is now booming in Asia, the Middle East, and Europe.

Cities like Dubai, Miami, and London remain hotspots, but secondary markets, from coastal Portugal to Saudi giga-projects, are fast becoming hubs of branded real estate development.

Emerging Trends

Diversification of Brands: Beyond hospitality, fashion (Bulgari, Armani), automotive (Porsche, Aston Martin), and even interior design houses are entering the market.

Sustainability Focus: Eco-conscious buyers expect LEED certification, renewable energy integration, and sustainable community design.

Wellness at the Core: Health, wellness, and longevity are now central to the branded living offer, think spa retreats, biophilic design, and medical concierge services.

Ultra-Exclusive Models: Limited-unit projects, often in partnership with high-end architects and designers, are catering to the super-prime niche.

For many HNWIs, real estate is no longer just about location or architecture. It’s about experience, identity, and assurance. Owning a branded residence is akin to owning a rare collectible: it signals taste, provides security, and offers utility.

As one Dubai broker recently put it: “High-net-worth buyers are no longer just looking for property. They’re investing in lifestyle, brand value, and long-term growth.”

Branded residences are more than homes, they are cultural statements and financial assets rolled into one. With the market projected to expand dramatically in the coming years, they represent a fusion of luxury, lifestyle, and investment opportunity that is set to define the future of high-end living.

Whether it’s the allure of living under a hotel flag, the prestige of a designer label, or the promise of turnkey luxury, branded residences are reshaping global real estate, and setting new benchmarks for how we define “home.”